SSS: Victims of 'Kristine' may avail of salary, pension loans

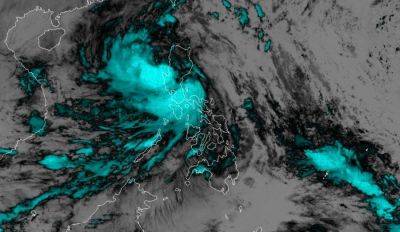

MANILA, Philippines — The Social Security System (SSS) said on Thursday, October 24, that members suffering from the effects of Severe Tropical Storm “Kristine” (international name: Trami) may immediately access salary and pension loans to aid their financial recovery.

According to the SSS Senior Vice President for Lending and Asset Management Group Pedro Baoy, the state insurer is ready to provide urgent financial support amid natural disasters.

For a one-month salary loan, members must meet these criteria:

For a two-month salary loan, members must meet these criteria:

Baoy emphasized that members who pay individually must have at least six posted contributions under their current membership type before they can apply for a loan.

He also reminded employers to ensure that employee contributions are up to date for members to qualify for a loan.

Retiree-pensioners may access a pension loan ranging from three to twelve times their basic monthly pension, plus an additional P1,000. However, the total loan amount cannot exceed P200,000.

The requirements are as follows:

Baoy said that retiree-pensioners who previously availed of an 18-month advance pension must have been receiving their regular pension for at least one month.

The loan application can be accessed and submitted digitally through My.SSS Portal. It may also be processed over the counter at an SSS branch.

Members with approved applications will receive their loans through their registered Unified Multi-Purpose Identification (UMID)-ATM Card.

The loans may also be credited to a member’s active accounts in a participating bank with PESONet or the Philippine Electronic Fund Transfer System and Operations Network.

According to the SSS, members have up to two years, or 24 equal monthly installments, to repay salary loans, which carry a 10% annual interest rate.

This means that if a member borrows P24,000, they can pay at most P1,000 a month for two years, including a monthly interest of P200. This brings the total repayment amount to P28,800 for the two-year amortization.

For pensioners, the loan amortization includes a 10% interest rate calculated on a diminishing principal balance. This means that