What happens if a REIT misses a dividend deadline?

In short, a REIT that fails to distribute 90% of its distributable income by the end of the 5th month following its fiscal year-end will lose a number of very beneficial tax treatments. First, we have to acknowledge that the consequences for violating the rule are tax-related; the REIT’s shares aren’t subject to suspension with the PSE, and the REIT’s authority to conduct business is not subject to suspension by the SEC. What happens is that the violating REIT would lose the exclusion that allows it to only pay income tax on the profit that is not distributed to shareholders, and it would lose the 50% savings on the DST it paid on the transfer of the properties into the REIT structure. Last, we have to acknowledge that a REIT would be subject to these penalties for failure to distribute 90% of its distributable income even if it paid the dividend on time, as it would if it paid over 90% of its distributable income in dividends but just paid those dividends late. The rules don’t provide REITs with partial marks for partial compliance. It’s an all-or-nothing deal, but it’s a little uncertain how any of these sanctions would be applied since it’s never happened before.

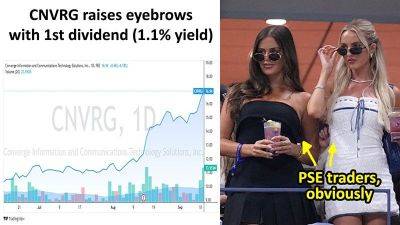

MB bottom-line: These questions might seem silly to traders using a short-term strategy like daytrading, but REIT investing is a long-term thing and for long-term investors, understanding the risks is a big part of the game. Is it likely that a REIT will violate the 90% rule or the dividend deadline? No, it’s not. No REIT has ever violated either rule in the 24 “REIT years” on the PSE so far. But if we were talking about the risks of preferred shares investing a couple of years ago we might have made the same comment about the outright non-payment of dividends, and then Phoenix Petroleum would have come along and perfectly demonstrated why long-term investors need to consider a wider range of failure states when doing a risk assessment. The counter-argument here is that there are no codified legal penalties for non-payment of preferred shares dividends, and the presence of burdensome consequences for REIT Law violations make it much less likely for parent/sponsor companies to allow their REIT