'Kristine' victims may avail of SSS loans

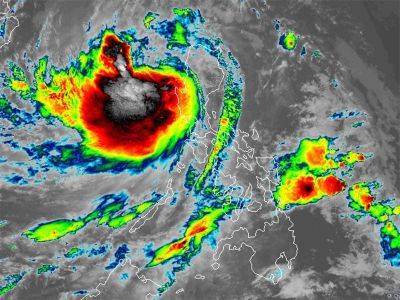

(UPDATE) THE Social Security System (SSS) said on Friday that its members affected by the onslaught of Severe Tropical Storm Kristine could avail of salary and pension loans.

SSS Senior Vice President for Lending and Asset Management Group Pedro Baoy said the loan programs have been readily made available as a proactive response to members' needs during calamities.

To qualify for a one-month salary loan, employed, self-employed and voluntary members must have 36 monthly contributions, six of which should be within the last 12 months before the month of the loan application.

Meanwhile, members should have at least 72 posted contributions if they opt to avail themselves of a two-month salary loan, Baoy said.

«They must be under 65 years of age at the time of loan application and have not been granted any final benefit like total disability, retirement, or death benefits,» he added.

Individually paying members must have at least six posted contributions under their current membership type before the month of the loan application.

Qualified members can submit their salary loan application online via My.SSS Portal.

AdvertisementOnce approved, loan proceeds will be credited to the member's registered unified multi-purpose identification automated teller machine card or active accounts with a Philippine Electronic Fund Transfer System and Operations Network participating bank.

Members can pay the salary loan in two years through 24 equal monthly amortizations with an annual interest rate of 10 percent.

Meanwhile, retiree-pensioners can avail themselves of the SSS pension loan equivalent to three, six, nine, and 12 times their Basic Monthly Pension plus P1,000 additional benefit, but not exceeding the maximum P200,000.

«If retiree-pensioners would avail of the 18 months advance pension, they must be receiving their regular monthly pension for at least one month,» Baoy said.