Most markets up ahead of Fed but Tokyo hit by strong yen

HONG KONG, China — Most Asian and European markets rose Tuesday but Tokyo sank more than one percent as exporters were hit by a stronger yen with traders gearing up for a bumper US interest rate cut and a key Japanese central bank meeting.

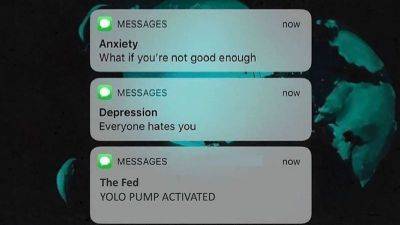

Bets on the Federal Reserve slashing borrowing costs by as much as half a percentage point have jumped in recent days, with observers suggesting officials want to front-load an expected series of reductions.

That has weighed on the dollar, which sank below 140 yen on Monday for the first time since summer 2023 and also weakened against its other major peers.

A string of data in the past few months has indicated that US inflation is easing back to the Fed's two-percent target, while the labour market is slowing, giving decision-makers room to loosen monetary policy.

Fed boss Jerome Powell has already suggested officials will begin cutting, but debate has focused on whether they will go for 25 basis points or 50, with some warning that the bigger option could signal there is some concern about the economy.

Successive big misses on jobs creation in July and August fanned fears of a recession, though policymakers have looked to temper that talk.

Independent analyst Stephen Innes said: "The labour market and inflation data haven't exactly screamed for a massive cut, but that hasn't stopped the market from placing its bets.

"With a 50-basis-point cut looking like a sure thing, disappointment could be on the horizon if the Fed pulls back with a mere 25 basis points.

"The first cut is just the appetiser, though -- the main course comes with Jay Powell's press conference and the Fed's dot plot, which will likely set the pace for the rest of the year," he added, referring to the bank's guidance on rates.

ACY Securities currency analyst Luca Santos said a 50-point cut could see the yen trade in the 130-140 range, adding that "volatility in the forex market highlights the sensitivity of investors to economic signals, particularly those related to monetary policy shifts".

The strengthening yen -- which is up around 13 percent from the four-decade low hit in July -- hit the Nikkei 225 in Tokyo.

The index fell one percent as traders returned