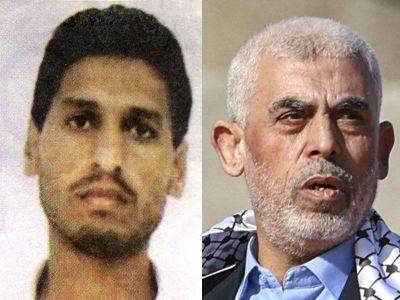

Philippine stocks fall after Hamas attack against Israel

MANILA, Philippines — Philippine stocks fell as the conflict between Israel and Palestine over the weekend weighed on market sentiment.

The Philippine Stock Exchange index (PSEi) fell 7.79 points or 0.12 percent to close at 6,252.16 yesterday.

Total value turnover reached P5.709 billion. Market breadth was positive, 94 to 86 while 56 issues were unchanged.

Juan Paolo Colet, managing director at China Bank Capital, said the local stock market slipped as investors became jittery due to the armed conflict between Israel and Hamas “which threatens to destabilize the Middle East.”

“Many participants opted to stay on the sidelines as they adopted a wait-and-see stance while the situation unfolds,” Colet said.

As this developed as Bloomberry said that it raised P5.6 billion from a recent private placement for 559 million shares at P10 per share. Proceeds from the share sale will be used by the company for debt service.

The two-day toll from the fighting in the Middle East surpassed 1,100 dead and thousands wounded on both sides. Palestinian militant groups claimed to be holding more than 130 captives from the Israeli side. Israel’s declaration of war raises the question if it would launch a ground assault into Gaza, which in past situations has resulted in heavy casualties

US Defense Secretary Lloyd Austin ordered the Ford carrier strike group to sail to the Eastern Mediterranean to be ready to assist Israel, in a move meant to help deter any regional expansion of the conflict.

On Friday, Wall Street rallied after investors studied the nuances of a surprisingly strong report on US employment that initially caused stocks to tumble on fears that upward pressure on inflation will lead the Federal Reserve to keep interest rates high.

Reports this week on inflation at both the consumer and wholesale levels are the next big data points due before the Fed makes its next announcement on interest rates on Nov. 1.

A strong job market also carries some rewards for financial markets in the short term. It means the economy is still doing well despite high rates, which could support corporate profits.