'Almost 2-year-low': Palitan ng piso vs dolyar sumadsad patungong P58.27 | Pilipino Star Ngayon

MANILA, Philippines — Nagsara ang palitan ng piso kontra dolyares sa pinakamababa nitong antas simula Oktubre 2022 matapos dumulas patungong P58.27, ayon sa pinakahuling datos ng Bankers Association of the Philippines.

Ito na ang pinakamababa nitong antas simula nang maitala ang all-time low na P59 kontra $1. Pero paliwanag ng Bangko Sentral ng Pilipinas (BSP), ganito rin aniya ang nararanasan ng mga ibang bansa sa ngayon.

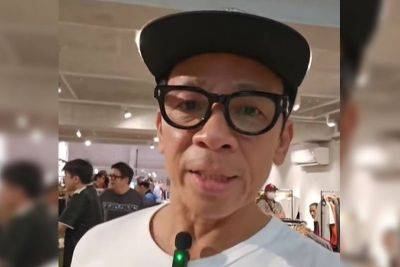

"The peso weakened beyoned the 58 to the US dollar today, in line with other currencies in the region," wika ni BSP Governor Eli Remolona Jr. ngayong Martes.

"The dollar continued to strengthen as the Federal Reserve signaled delay in cutting interest rates."

Statement of BSP Governor Eli Remolona Jr. on the peso: pic.twitter.com/D7vuoMR9Ry

Lunes lang nang magsara ang palitan ng piso kontra dolyar sa P57.9. Dahil diyan, P0.37 ang "idinepreciate" ng Philippine Peso.

Tuwing humihina ang piso (peso depreciation), lumalaki ang halagang naipapadala ng mga overseas Filipino workers sa kanilang mga pamilya sa Pilipinas oras na ipapalit nila ang dolyar.

Sa kabilang banda, nagiging epekto nito ang mas mahal na halaga ng foreign goods and services sa mga Pilipino.

Ilang beses na ring lumobo pataas ang utang ng Pilipinas bilang epekto ng depreciation, ayon sa Bureau of Treasury.

"The BSP continues to monitor the foreign exchange market but aallows the market to function without aiming to protect a certain exchange rate," patuloy ni Remolona.

"Nonetheless, the BSP will participate in the market when necessary to smoothen excessive volatility and restore order during periods of stress." — may mga ulat mula kay The STAR/Keisha Ta-Asan